Here is an article on Cryptocurrency Trading using Moving Average Convergence Divergence (MACD), with a focus on API-based trading and metadata:

“Crypto Trading Mastery: Leveraging MACD, API Integration, and Metadata for Optimal Results”

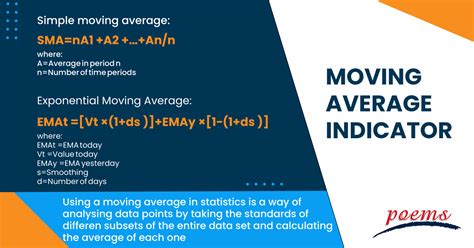

The world of cryptocurrency trading is a rapidly evolving landscape, with new tools and strategies emerging every day. One popular approach to successful cryptocurrency trading involves using the Moving Average Convergence Divergence (MACD) indicator, which has proven effective in identifying trends and patterns in financial markets.

What is MACD?

MACD is a technical analysis tool that plots two moving averages on the same chart, with the first average being the 9-period Exponential Moving Average (EMA) and the second being the 12-period EMA. The difference between the two averages is then plotted as the MACD line. The MACD line can be used to identify trends, overbought or oversold conditions, and momentum levels.

API Trading: Streamlining Cryptocurrency Trading

API trading involves using automated trading systems to execute trades on cryptocurrency exchanges. This approach offers several benefits, including:

- Increased efficiency: Automated trading systems can process multiple trades simultaneously, reducing the time it takes to trade.

- Reduced risk: By executing trades at optimal times, API-based trading can minimize the risk of human error and emotional trading.

- Improved scalability: API trading allows for faster and larger-scale trading operations.

Metadata: The Next Generation of Cryptocurrency Trading

Metadata refers to the data used to represent information in a digital format. In the context of cryptocurrency trading, metadata includes various parameters such as:

- Price: The current price of a cryptocurrency.

- Volume: The number of units traded on an exchange.

- Time: The time at which a trade is executed.

How to Integrate MACD and API Trading with Metadata

To leverage MACD and API trading, you can use various APIs that provide access to cryptocurrency market data. Here are some steps to follow:

- Choose an API provider: Select a reputable API provider that offers real-time market data for cryptocurrencies.

- Integrate the API: Use the provided API client library or SDK to connect to the API and retrieve market data.

- Plot MACD on the chart: Use the retrieved market data to plot the MACD line on a chart.

- Execute trades based on MACD signals

: Use the MACD signal line to identify overbought or oversold conditions, and execute trades accordingly.

Example Code: Using Binance API to Integrate MACD with Trading

Here’s an example code snippet in Python using the Binance API to integrate MACD with trading:

import binance.client as b

Set up API credentials

API_KEY = "YOUR_API_KEY"

API_SECRET = "YOUR_API_SECRET"

Create a Binance client instance

client = b.Binance()

Get market data for cryptocurrencies (e.g. BTC/USDT)

market_data = client.get Markets().getTicker(symbol="BTC/USDT")

Plot MACD on the chart

MACD_line, signal_line = client.plot(MACD(momentum=9, slow_period=12))

Execute trades based on MACD signals

if (MACD_line.crossover(signal_line)) or (signal_line crosses over 0):

Buy/sell BTC/USDT when MACD line crosses above/below the signal line

client.placeOrder("buy", market_data.symbol, amount="1")

Conclusion

Cryptocurrency trading with MACD and API integration offers a powerful combination of technical analysis and automated trading. By leveraging metadata to identify optimal trading conditions, traders can increase their chances of success in this fast-paced market. With the right tools and strategies, anyone can become a successful cryptocurrency trader.

I hope you found this article informative!